It’s become somewhat of a tradition for the tech sector to stop for an hour every year and listen to what former Morgan Stanley analyst and current Kleiner Perkins (KPCB) investor Mary Meeker sees as the important Internet trends of the moment.

Meeker, who delivered her annual internet report at the Code Conference in Rancho Palos Verdes, California, on Wednesday (a day before reports emerged that the US economy shrank last quarter), painted a fairly rosy picture of the current health and future prospects of the technology sector, both nationally and globally. This despite lots of chatter in recent months from the peanut gallery (including Fox Business) that we're experiencing a technology bubble.

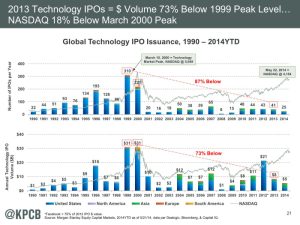

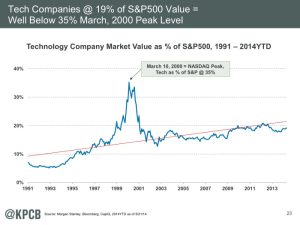

In her presentation, which included 164 densely packed slides, Meeker acknowledged that some tech company valuations are indeed high, and that Internet growth slowed to less than 10 percent last year (down from near 20 percent in 2007, and nearly 40 percent growth in 2002). Nevertheless, the signs of a bubble that were present in the late '90s, like frequent initial public offerings and unreasonably inflated stock valuations in the technology sector, are not present today, she said.

Rather, Meeker suggests that the technology industry can continue to party like it's 1999 (that is, before the dot-com bubble burst), based on some other indicators of the industry's robust health.

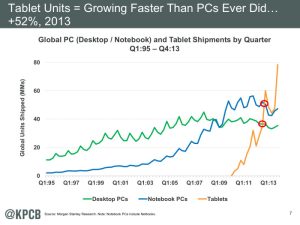

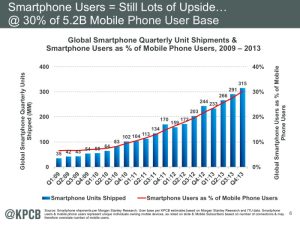

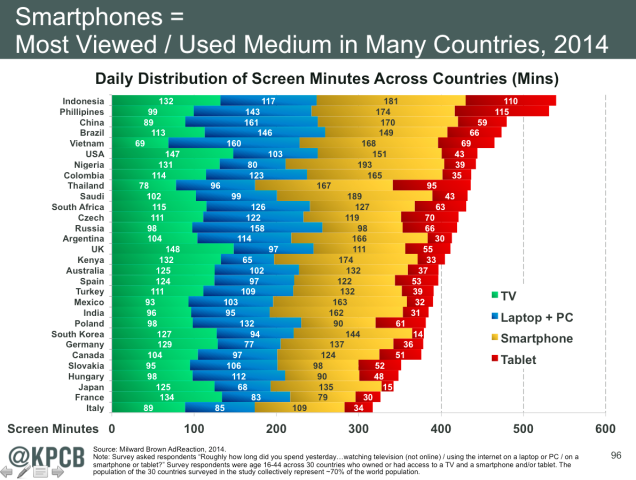

Meeker points to various trends, including the massive surges in mobile Internet use, which constitutes nearly 25 percent of all Internet traffic, as well as a global spike in the adoption of tablet computers to support her argument.

What's more, she highlights the rise of the visual Web (including the increasing popularity of services like Instagram, Pinterest, and Snapchat) and the rising significance of the Chinese market (with the Chinese-based services Baidu, Alibaba, and Sohu all making the 2014 list of the top ten Web properties based on site traffic) as several of the factors that contributed to her optimistic forecast.

What Meeker's slides and analysis suggest is that while 2014 doesn't quite look like 2000, when the dot-com bubble burst, it might be looking more like 1998, as Forbes argues.

Let's hope Meeker is right.

reader comments

46