Ever been treated badly by companies but felt unsure about how to fight back? Next time, try publicly shaming them on Twitter.

While Twitter's hand in unsettling repressive political regimes has been lauded by media (see: “Arab Spring,” the wave of demonstrations, protests, riots, and civil wars that rocked the Arab world beginning in 2011), the service has also proven to be a surprisingly effective tool for bringing much-needed accountability to corporations that mistreat their customers.

A few recent case-study examples of individuals who felt they were wronged by corporations and then took to the Twitterverse to air their grievances show how a properly placed tweet can be a powerful weapon for consumers to combat corporate malfeasance.

Mandatory arbitration: Dislike

For instance, after General Mills—one of the country's largest food companies—initially announced last week that “Liking” the company on Facebook could result in an effective waiver of a consumer’s right to sue the company, users flocked to General Mills' Twitter and Facebook pages to express their dissatisfaction with the new provisions.

The company, known for manufacturing such popular items as Cheerios and Pillsbury Crescent Rolls, quickly responded to the backlash, performing a complete about-face. General Mills decided on Saturday to withdraw its recently announced updated terms of service that would have made it more difficult for many customers to sue the company.

In a blog post entitled, “We’ve listened – and we’re changing our terms back,” General Mills Spokeswoman Kirstie Foster explained, “We rarely have disputes with consumers – and arbitration would have simply streamlined how complaints are handled. Many companies do the same, and we felt it would be helpful. But consumers didn’t like it. So we’ve reverted back to our prior terms.”

Foster continued, "We'll just add that we never imagined this reaction. We're sorry we even started down this path."

Loan repayment

After 24-year-old law student Andrew Katbi died in a tragic 95-car pile-up while returning to Duke (where he was enrolled) from a camping trip in Virginia, not only did his family have to cope with his loss, they were further tormented by one of the companies that had been servicing his student loans, Sallie Mae.

Given the high sticker price of law school, Katbi's parents were not in a position to pay their son's six-figure tuition out-of-pocket, so he did what lots of American students in the higher education system do, he took out loans. Given Andrew's short credit history, his mother co-signed his student debt.

After their son was killed in a car crash just weeks before his graduation, in March 2013, his grief-stricken parents sent death certificates to the three companies servicing his loans, Sallie Mae, Citi, and Discover. Citi and Discover immediately forgave the loans, but Sallie Mae did not.

Rather, the company rolled the balance of Andrew's loans over to his mother and began to harass the family with phone calls and voicemail, some of which asked for Andrew to call back. Sallie Mae employees also apparently told the family that if they could not pay back the loan, perhaps they could get Duke University to do so, according to Jezebel.

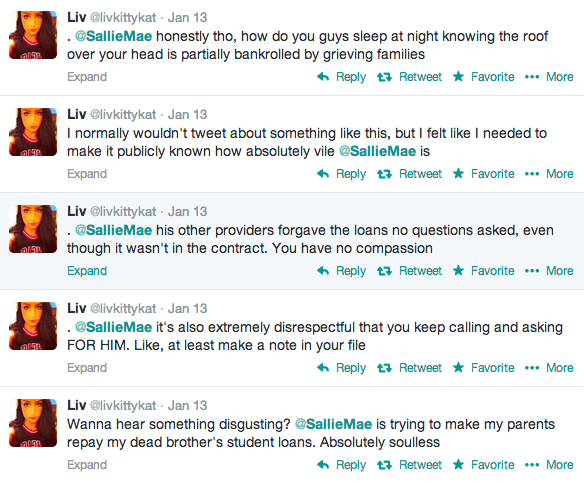

Andrew's sister, Olivia Katbi, after hearing her parents plead with the company on the phone for hours on end on multiple occasions, decided to take matters into her own hands. Believing that Sallie Mae had acted callously and inappropriately in their dealings with her family, Olivia took to Twitter to voice her understandable frustration. Hoping that her story would shame the company into doing the right thing, she began publicly tweeting her story at the company.

Olivia's story set loose a torrent of other Twitter users who described their own bad experiences dealing with Sallie Mae. The public relations nightmare that ensued spurred the company to quickly settle with the Katbi family in January 2014. As part of the agreement, however, the family was not allowed to comment upon its terms.

Sallie Mae did not respond to our multiple requests for comment.

Frisking Forrester

Likewise, TV and film star Rob Brown, best known for his roles in the HBO series Treme and as the lead alongside Sean Connery in the film Finding Forrester, took to Twitter last year to vent his frustration toward a company that mistreated him: Macy's.

While shopping for a last-minute present for his mother, who was graduating from Metropolitan Community College the day that he entered the Macy’s flagship store in New York City on June 8, 2013, Brown found himself treated quite poorly by Macy's staff and the New York Police Department (NYPD).

After attempting to purchase a $1,300 Movado watch, Brown, who is African-American, was handcuffed and alleges he was “paraded” through the store like a criminal before being placed in a holding cell at Macy’s. This despite his claims that his credit card had not been declined and that he had provided back up identification.

Allegedly, NYPD officers told Brown that “he could not afford to make such an expensive purchase,” and once the officers recognized their mistake, they drove Brown to his mother’s graduation ceremony with the sirens blaring.

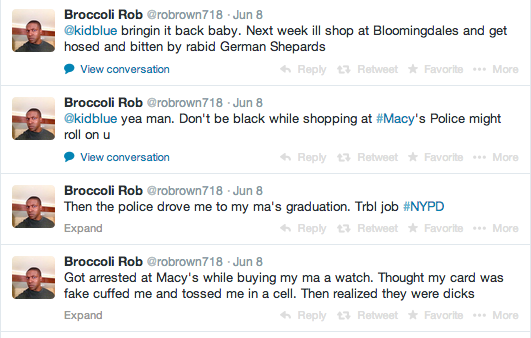

Brown explained to the New York Daily News, “To be late for my mother’s graduation ceremony, that was devastating.” After Brown was released, he took to Twitter to express his discontentment at what has been called his “shop-and-frisk” incident. His tweets included the following statements:

Brown’s Twitter rant unleashed a media firestorm against Macy’s, which undoubtedly tarnished the company’s image in the eyes of many consumers.

Moving a step beyond Twitter-shaming, Brown then filed a federal class-action racial profiling lawsuit against Macy’s, explaining to the New York Daily News that Macy’s security “policies and practices have left… customers of color feeling victimized, humiliated, traumatized.”

In response to questions about how the company handles customer criticism on social media applications, Macy's spokesman Orlando Veras told Ars, "Social media engagement is an important aspect of Macy's brand communication strategy… When issues arise we look to proactively communicate to resolve disputes, correct misinformation, and explain company positions." Veras continued, "Our aim is to resolve each unique situation in a manner that is in keeping with the company's overall brand values and reputation."

reader comments

121