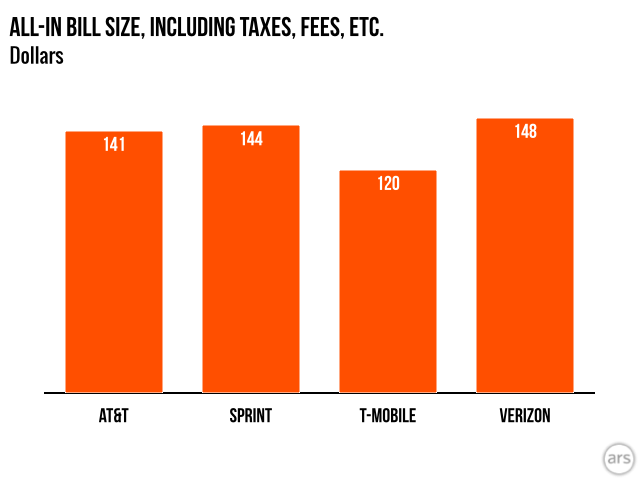

Verizon Wireless has the largest average bill size among the four major mobile carriers in the US, while T-Mobile has the lowest, according to a survey released yesterday by research firm Cowen and Company.

The survey of 1,876 US-based mobile customers in Q4 2013 pegged the average monthly Verizon bill at $148, higher than Sprint ($144), AT&T ($141), and T-Mobile ($120):

The numbers reflect postpaid subscribers and include all taxes and fees. They include both single users and family plan customers. Across the industry, 68.5 percent of postpaid respondents were paying for family plans, with 26.1 percent on individual plans and 5.4 percent on corporate plans. Verizon had the most family and corporate plans, with 72.3 percent of respondents paying for family plans and 7.0 percent on corporate plans. The report did not break out the average individual bill size by carrier.

This was the second time Cowen performed the quarterly survey. It uses a random sample, so the respondents are different each time. In Q3 2013, Verizon also led with an average bill size of $153, and T-Mobile had the lowest with $133. AT&T and Sprint switched places, with AT&T averaging $147 in Q3 2013 and Sprint averaging $143.

A Verizon spokesperson declined to comment on the findings but said, "we do offer many options at different price points for customers so they can find the plan that suits them best."

Cowen tried to determine what percentage of customers plan to leave their wireless carriers, but the numbers fluctuated wildly between Q3 and Q4 with no explanation, making it hard to know whether to take the answers seriously. When asked if they plan to switch from their current providers, 17 percent of Verizon postpaid customers said yes in Q4, up from 15.7 percent the previous quarter. 15.4 percent of T-Mobile customers said yes to the same question, down from 42.9 percent the previous quarter. 31.4 percent of Sprint customers said they plan to switch, down from 41.7 percent the previous quarter. 11.1 percent of AT&T customers said they plan to switch, down from 31.6 percent the previous quarter.

Actual customer turnover is more consistent over time. UBS research found that in 2012, Verizon lost 0.91 percent of its customers each month, while AT&T lost 1.08 percent, Sprint lost 2.02 percent, and T-Mobile lost 2.35 percent, according to a Wall Street Journal article in July 2013. T-Mobile may end up stealing more customers from its rivals than usual, however, because of its new offer to pay off the early termination fees of customers who switch and turn in their old phones.

The carriers' various perceived strengths came through when Cowen and Company asked customers why they chose their service provider. "The top responses for why respondents chose their current carrier for AT&T were network coverage and quality," the Cowen report said. "Similar to last [quarter], the top reasons for choosing Sprint was for the unlimited data plan and better price, for T-Mobile was better price and unlimited data plan, and for Verizon was network coverage and network quality."

Most customers who plan on switching want to do so to get a lower price, Cowen's survey found.

Overall, 80 percent of customers were on postpaid plans. 42.2 percent of postpaid respondents were Verizon customers, 34.4 percent were AT&T customers, 11.1 percent were Sprint customers, and 7.7 percent were T-Mobile customers.

LTE and the iPhone are both revenue drivers for carriers, perhaps contributing to the sizable AT&T and Verizon bills. LTE users and iPhone owners generally use more data than 3G users and Android phone owners, increasing the need to buy a more expensive plan. "LTE individual-plan postpaid subscribers generate $103 (including taxes) whereas non LTE individual-plan postpaid subscribers generate $76 (including taxes)," Cowen's report said.

Similarly, iPhones generated significantly more revenue than Android phones and non-smartphones. "Individual-plan postpaid iPhones generate $104 (including taxes) whereas Smartphones non-iPhones generate $94 (including taxes) and non- Smartphones just $63 (including taxes)," the report said. In the survey sample, 49.1 percent of postpaid and prepaid iPhone users were AT&T customers, 36.7 percent were Verizon customers, 8.7 percent used Sprint, and 2.7 percent used T-Mobile.

Reader Comments (138)

View comments on forumLoading comments...