The scourge of global tax evasion screamed back into the news this week, erupting from the giant Panama Papers leak.

While many of the initial revelations have centered around figures from Europe and emerging markets such as Russia, China, and Ukraine, relatively few bombshells have emerged as yet about tax shenanigans by wealthy Americans.

That could be simply a matter of time, as journalists work their way through the trove of more than 11 million documents. (Some 200 American passports have washed up in the data, according to US news company McClatchy.) But it also may reflect the reality.

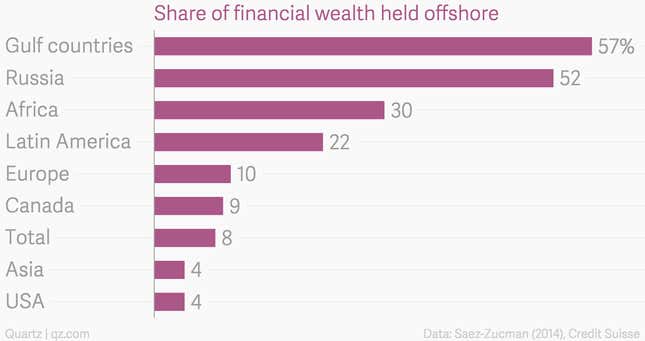

Unlike in emerging markets and in Europe, the main US tax avoidance problem isn’t about individuals. Data on financial assets such as stocks and bonds (above), instruments in which affluent people tend to park their wealth, show a relatively small share of US money is kept offshore.

No, in the US, tax avoidance has more to do with corporations. And much of that dodging has increasingly been done in the clear, bright light of public view.

In his terrific recent book on what he calls the “scourge of tax havens,” Gabriel Zucman, an economist at the University of California, Berkeley, estimates that the artificial shifting of profits to low-tax locales such as Ireland, Switzerland, and the Bahamas reduces US corporate tax liabilities by $130 billion per year.

But the US Treasury Department is taking steps to address this. On April 4, it imposed new limits on so-called tax inversions, a type of deal in which a US company merges with a smaller firm in a foreign country where taxes are lower, adopts the foreign address, and takes advantage of the discrepancy in tax rates.

Such deals have been one of the most popular type of M&A transaction in recent years. The $160 billion deal between US drug giant Pfizer and Ireland-based Allergan is perhaps the most eye-popping example of this.

Or at least it was. The new Treasury Department rules will be applied to deals that close after April 4. And since some loose ends on the Pfizer/Allergan deal remain, Allergan shares got hammered, as investors realized that a completion of the combination might not come to pass.

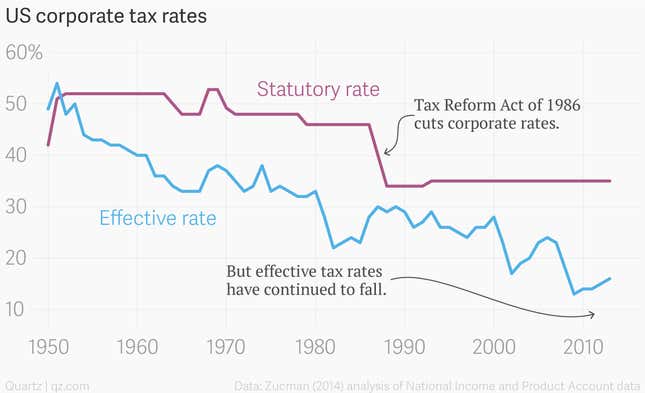

An effort to curtail the usage of low-tax locales by US corporations is long overdue, since the relentless decline in US effective tax rates for corporations comes even as official corporate tax rates have stayed stable in recent years.

The decline of effective corporate tax rates suggests something is going on. Zucman estimates that about two-thirds of this decline is due to the artificial shifting of corporate profits to low-tax locales. In other words, tax avoidance.