Startup accelerators are an excellent way for early stage startups to get up to speed quickly, identifying their best growth strategy and a reasonable plan to achieve it. The number of accelerators has dramatically increased over the past few years, with many new programs appearing in large metropolitan areas rich with startups.

At the same time, competition for participation in these accelerators has increased, as evidenced by the growing number of applications from startups clamoring for a coveted spot in the accelerator’s next cohort. But is participation in an accelerator program the best next step for all startups? What are the pros and cons of participation?

In my discussions with founders who had participated in accelerator programs, I’ve found that while many deemed them a success — sometimes a big one — there are several instances where the program wasn’t seen as timely for the startup. Others declared victory, but wondered if the accelerator they chose was, in fact, the best choice for their startup. Reviewing the situations in which participation is warranted, and the subsequent selection of programs, is a useful process for founders of any early stage startup.

The traditional accelerator model is based on a program that from a large group of applicants selects around 10 startups to participate in a fixed-term cohort of companies. In exchange for a small seed investment for equity, the accelerator’s management team executes their fast-paced, mentor-based program, ending in each startup presenting to a large group of eager prospective investors a formal pitch for funds.

In consideration of the spectrum of evolution for startups, some just aren’t sufficiently mature to benefit from what the traditional accelerator has to offer. That is, their team, idea or market fit has not evolved sufficiently to withstand superficial scrutiny. Other startups may be so mature that they don’t need the accelerator’s primary benefits.

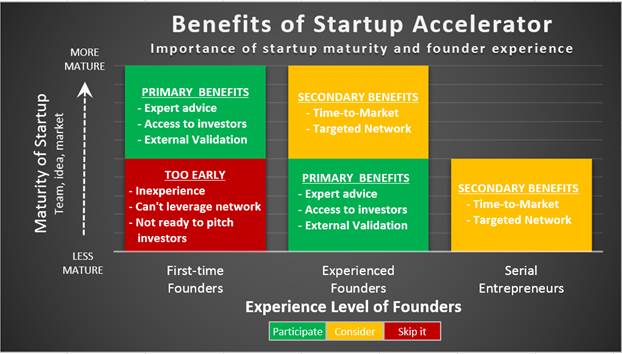

First-time founders and experienced entrepreneurs will likely benefit most from all the accelerator’s benefits. Because time-to-market can be critical, even serial entrepreneurs may choose to participate for reasons specific to their startup. The importance of startup maturity and founder experience are summarized in the chart below.

A Founder’s First Major Business Decision: Accelerate?

A startup accelerator isn’t necessarily the perfect next step for every startup, so understanding the pros and cons is important. Deciding if participation in an accelerator is best for their startup can be the first major decision for founders. Careful evaluation of the primary costs and benefits can readily answer whether or not participation is worthwhile.

| Primary Characteristics of Accelerators | |

| Costs | Benefits |

| Equity | Expert advice |

| Opportunity | Access to investors |

| External validation | |

Primary Costs: Participating in an accelerator is a significant business decision for the founders. There are two primary costs associated with participating: equity and opportunity. The traditional accelerator takes 5-10 percent pre-seed equity in the startup. Equity is often the only currency the founders have to get premium assistance. It’s an ideal trade if the assistance has a direct positive impact on the valuation of these early stage startups, increasing the value of their equity. Both the startup founders and the accelerator investors are winners.

Founders also must consider the opportunity costs associated with the accelerator program. The opportunity cost is related to the benefit the startup could realize if they had performed an alternative action instead of participating in the accelerator. Accelerators require a serious time investment that can weigh heavily on the decision to participate. The accelerator program is typically a 3-6 month term, and may include a temporary relocation for all the participating founders.

A startup accelerator isn’t necessarily the perfect next step for every startup.

Opportunity costs can be significant because the early days of a startup’s creation can be the most important. Pre-revenue startups may be more flexible to arrange participation in an accelerator program, while post-revenue startups find it more difficult to manage their other operational priorities with a typically thin staff.

Primary Benefits: While equity and opportunity costs are important to consider, accelerators bring so many benefits that the decision to participate can be a no-brainer. The primary benefits can be grouped into three areas: expert advice, access to investors and external validation.

Probably the most important benefit of an accelerator is the expert advice the founders receive from the “mentor network,” an often star-studded team of entrepreneurs, market strategists and business experts. Some mentor networks include notable entrepreneurs that founded unicorns and well-known startups. Other mentors usually include serial entrepreneurs, significant non-founder startup participants, C-level professionals, investors, members of the accelerator’s management team and alumni.

To benefit from the mentor network, founders must realize what mentors are not. They are not a due diligence team driven to dissect and test the startup’s strategy, team and market. On the contrary, they are a premium resource for experience-based advice available to the founders.

These mentors are not normally compensated. Their primary interest is to share what they’ve learned from building a company and to give back to the community of startups. Startups need to be sufficiently prepared to be able to leverage the mentor networks knowing which questions to ask and why the information is important.

Merely receiving an entrepreneurial education is not sufficient for startups to justify surrendering equity.

Without adequate foresight and preparation, it will be impossible to extract the most important benefits that are available from that network. Some mentors may be key C-level executives to which the founders may not otherwise have access outside the accelerator. This is a significant benefit. The more effort founders put toward preparing to interface with that resource, the more they benefit.

Note that merely receiving an entrepreneurial education is not sufficient for startups to justify surrendering equity. There are plenty of other sources for this type of education.

To best leverage the mentor network, startup founders need to review each mentor’s background, including their knowledge of and experience with funding, marketing, design, accounting and intellectual property.

Once they understand the landscape of a mentor’s background, they can seek the detailed information they need to support their startup’s product idea, team, product/market fit and financial plan, interfacing efficiently and respecting that the mentor’s time is valuable. Sometimes, founders will receive seemingly conflicting guidance from different mentors and will need to resolve amongst themselves which information to heed.

A second primary benefit from participation in an accelerator is access to investors, including finalizing the business case and preparing the startup pitch. Accelerators typically have angel investors and venture capitalists rooted into their programs, engaged in the initial funding of cohorts, partaking in mentoring activities and participating in Demo Day, the final presentation of the startup’s investor pitch.

As a result of their participation in the accelerators, startups are provided a solid introduction to these investors, an enormous benefit for any founders that have performed their fundraising activities. To extract the most benefit from fundraising, the founders need to have a clear understanding of their finances, the magnitude of the desired funding and a clear plan for its use based on reasonable future projections for both revenue and costs.

Note that fundraising isn’t always a desired goal, as some founders may choose to bootstrap their startup, building the company from personal finances and operating revenues, or obtaining low-interest loans. In this way, founders can increase their value in the enterprise without giving up valuable early equity. But for those startups that seek capital to fund their endeavor and minimize their all-important time-to-market, the accelerator’s path to fundraising can be vital.

Many founders consider the small seed investment as the “trigger” they need to commit 100 percent to their startup.

A third benefit to accelerator participation is external validation. In light of the growing demand for accelerators, acceptance can be highly competitive and entry as difficult as a high school senior applying to an Ivy League college. Acceptance into the accelerator program can bring with it a significant amount of esteem, particularly for the most competitive accelerators.

Often, startups listing these accelerators on their resume have a notable “stamp of approval” that helps them attract the most attention from investors and improves their ability to recruit rock stars for their teams.

Along with the validation associated with their startup’s acceptance to the accelerator, many founders consider the small seed investment (usually only $15,000-$40,000 for 5-10 percent equity) as the “trigger” they need to commit 100 percent of their time to their startup. Although it may be the first source of financing for early stage startups, it isn’t normally enough to fund much of the startup’s activities. As a testament to the soundness of their startup strategy and team, it can be the turning point for their dedication to the endeavor.

Startups may enjoy one or more of these primary benefits, as well as a plethora of additional secondary benefits, such as access to specific C-level mentors and investors, participation with other startup founders in the accelerator community and access to certain specific alumni.

Some startups may participate in multiple accelerator programs, each for different/specific reasons. For example, their first participation may be to reduce time-to-market by receiving expert advice from C-level executives not easily accessed by other means. Later, after completing an initial development effort on their MVP, they may choose to participate to solidify their financial plan, refine their pitch and meet key candidate investors. Of course, startups participating in multiple programs need to be certain that such a plan is necessary, as equity is paid each time.

Choosing An Accelerator

For startups that make the decision to participate in an accelerator, there are quite a few choices with a lot of diversity. Once the founders prioritize the benefits that are most important for their startup, they can better select the accelerator candidates that may best serve their interests. Most of the new accelerators are located in large metropolitan areas where many new startups have appeared. To better serve the vastly different types of startups that seek acceleration, there are now different types of accelerators with a primary focus theme that’s either aligned with vertical markets or with horizontal technologies.

To better serve the vastly different types of startups that seek acceleration, there are now different types of accelerators.

It’s important for founders to consider the pros and cons of each accelerator type so they can reap the most rewarding experience possible for their startup. While new accelerators seem to appear at a rapid rate, it is useful to refer to websites that maintain a database of accelerators. For example, Seed-DB is based on the CrunchBase API and delivers live, up-to-date information on companies, their exits, funding and activities. Another website that breaks down the focus area for accelerators is Global Accelerator Network.

Vertical Accelerators: Vertical accelerators engage those startups that are targeting a specific industry, trade or customer type. In the “vertical” niche, a diversity of companies market products and services to that same group. For accelerators, the vertical theme is chosen to leverage the unique strengths of the regional investor community in that specific vertical market and to build a mentor network around it. Of the vertically themed accelerators, the most common themes include financial technology (fintech), health and education technology (edtech), energy, media, real estate and fashion. Accelerators also exist in diverse vertical markets, including hospitality, non-profit, film and food.

Techstars is one of the largest accelerator organizations, and likely has the most accelerator locations. They have partnered with many organizations to deliver a diversity of vertically focused programs, including:

- Barclays Accelerator (since 2013), located in London, New York and Tel Aviv.

- Disney Accelerator (since 2014), focused on media and entertainment, located in Los Angeles.

- Kaplan Accelerator (since 2014), focused on education technology, located in NYC.

- Sprint Accelerator (since 2015), focused on mobile health products, located in Kansas City.

- Target Accelerator (starting in 2016), focused on retail tech, located in Minneapolis.

These accelerators create an entire ecosystem based on the vertical, with a strong theme-based mentor network and a highly engaged investor community. For the startup that intends to promote a product targeting customers in one of these specific vertical markets, it can make perfect sense to target those accelerator programs that are focused on their theme.

Horizontal Accelerators: For those startups targeting a specific product or technology that finds customers in more than one market, horizontal accelerators can be a great solution. The “horizontal” theme refers to accelerators focused on startups that intend to develop a product or service that meets a similar customer need across different market niches.

For example, IoT/connected devices, enterprise software, SaaS and cloud. Similar to vertical accelerators, the horizontal theme is chosen to leverage the unique strengths of the investor community that have an interest in that specific type of product/technology and to build a mentor network with relevant experience.

There are accelerators focused on Internet of Things (IoT) products. These include:

- Two Techstars-powered programs in NYC, one at R/GA for connected devices and another to be launched with PwC in 2016.

- Seamless Accelerator in Grand Rapids, MI, which collaborates with some local enterprise-level companies.

- AlphaLab, accelerator for hardware and physical devices, located in Pittsburgh since 2008.

Importance Of Location: There are two primary situations where a startup may select candidate accelerators based on their location. First, the founders are unable to relocate during the cohort because of local commitments either to their local startup operations or other responsibilities.

A second reason for selecting an accelerator in a specific location is because that location is where a significant number of the startup’s customers are located. The ecosystem works best if the accelerator is located in an area rich with the customer types that are of interest to the startup, because vertical themes are fundamentally embedded in the community and the mentor networks there. Also, in those locations, there are many investors with a diversity of funds indexed for those vertical markets.

For example, ClassPass is a startup offering a multi-location membership program for fitness classes. They were well-suited to participate in the Techstars NYC accelerator program in 2012. Because there is such a diversity of fitness programs in New York City, it was very easy to appreciate the value that the startup was delivering. It’s likely that the accelerator’s New York ecosystem contributed to the startup’s early success. On the other hand, a startup with a gaming product may not be successful in an NYC accelerator because the market for games and interactive media is primarily on the West Coast.

Other Factors: There are many other reasons to choose from one of the available accelerator programs. For example, some accelerator programs focus on women-led startups, the first such program being Springboard Accelerator, whose mission it is to “cultivate and promote the talented women entrepreneurs around the world.” Similarly, MergeLane is a Boulder accelerator dedicated to women-run companies. They’ve modified their program to be more appealing to mothers with family responsibilities.

Most founders of early stage startups agree that accelerator programs are an excellent way to get their startup up-to-speed. Mature startups and experienced founders benefit most often, but, in certain situations, even serial entrepreneurs are able to leverage the network and reduce time-to-market. Founders need to carefully evaluate the accelerator program options available to them in consideration of the primary benefits that they seek from participation.