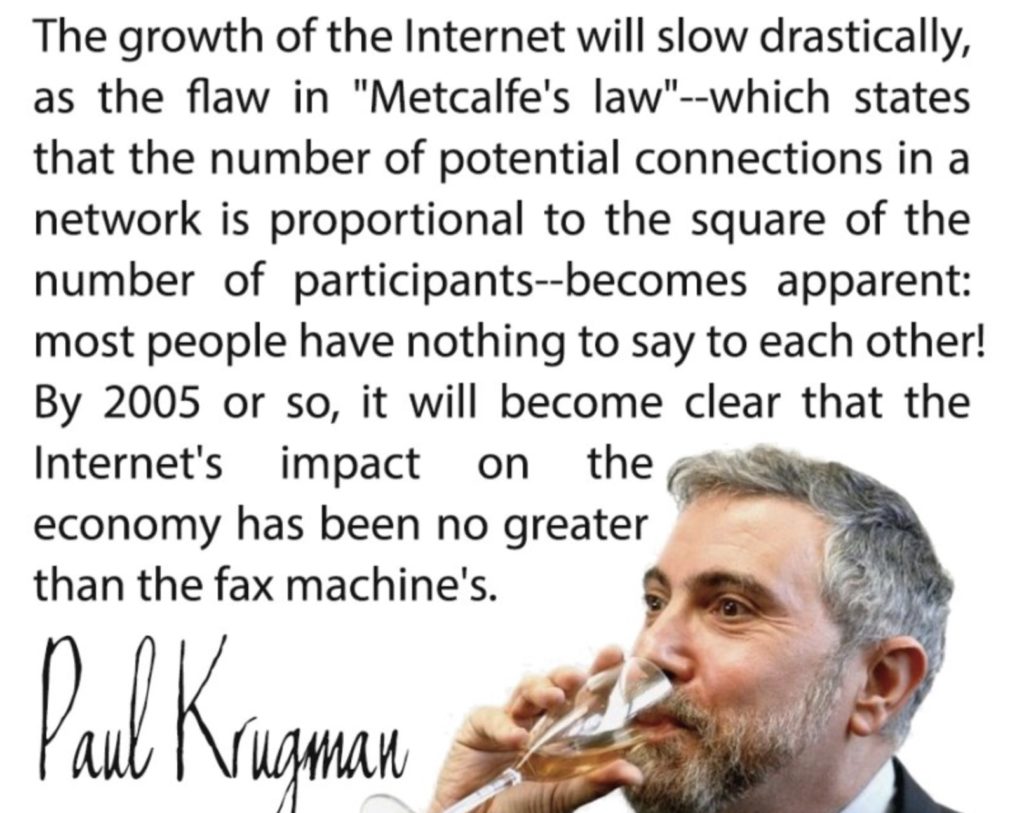

Paul Krugman made the above statement in 1998, and while I stand guilty for plenty of bad forecasts, Krugman’s internet call is arguably the worst prediction in human history. Naturally, that doesn’t prevent the man from retaining his tenured position of punditry at the New York Times, a perch from which he continues expose millions of unsuspecting Americans to his incoherent, status quo coddling nonsense.

It appears Senator Elizabeth Warren of Massachusetts has had enough.

The Huffington Post reports:

WASHINGTON — Sen. Elizabeth Warren (D-Mass.) appeared to offer a thinly veiled rebuke of liberal economist Paul Krugman on Wednesday by highlighting a “scary” too-big-to-fail ruling from federal bank regulators.

The Federal Reserve and the FDIC said Wednesday that five of the biggest banks in the country cannot credibly be unwound safely without bailout money from taxpayers.

“This announcement is a very big deal. It’s scary,” Warren said in a written statement. “After an extensive, multi-year review process, federal regulators concluded that five of the country’s biggest banks are still — literally — too big to fail. They officially determined that five U.S. banks are large enough that any one of them could crash the economy again if they started to fail and were not bailed out.”

But Warren directed her sharpest words at an unnamed set of people who have recently downplayed the role of big banks in the financial crisis and questioned the value of breaking up big banks — an apparent reference to the Nobel Prize-winning Krugman.

“There’s been a lot of revisionist history floating around lately that the Too Big to Fail banks weren’t really responsible for the financial crisis,” Warren said. That talk isn’t new. Wall Street lobbyists have tried to deflect blame for years. But the claim is absolutely untrue.”

“There would have been no crisis without these giant banks,” Warren continued. “They encouraged reckless mortgage lending both by gobbling up an endless stream of mortgages to securitize and by funding the slimy subprime lenders who peddled their miserable products to millions of American families. The giant banks spread that risk throughout the financial system by misleading investors about the quality of the mortgages in the securities they were offering.”

On Friday, Krugman argued that the financial crisis wasn’t really a problem of too big to fail, but rather a failure to regulate so-called shadow banks — a broad term including just about every financial activity beyond traditional loans and deposits.

So what was Senator Warren referring to in the article above? For more on this key topic, let’s turn to the always excellent Wall Street on Parade:

Yesterday the Federal Reserve released a 19-page letter that it and the FDIC had issued to Jamie Dimon, the Chairman and CEO of JPMorgan Chase, on April 12 as a result of its failure to present a credible plan for winding itself down if the bank failed. The letter carried frightening passages and large blocks of redacted material in critical areas, instilling in any careful reader a sense of panic about the U.S. financial system.

A rational observer of Wall Street’s serial hubris might have expected some key segments of this letter to make it into the business press. A mere eight years ago the United States experienced a complete meltdown of its financial system, leading to the worst economic collapse since the Great Depression. President Obama and regulators have been assuring us over these intervening eight years that things are under control as a result of the Dodd-Frank financial reform legislation. But according to the letter the Fed and FDIC issued on April 12 to JPMorgan Chase, the country’s largest bank with over $2 trillion in assets and $51 trillion in notional amounts of derivatives, things are decidedly not under control.

It’s important to parse the phrasing of that sentence. The Federal regulators didn’t say JPMorgan could pose a threat to its shareholders or Wall Street or the markets. It said the potential threat was to “the financial stability of the United States.”

That statement should strike fear into even the likes of presidential candidate Hillary Clinton who has been tilting at the shadows in shadow banks while buying into the Paul Krugman nonsense that “Dodd-Frank Financial Reform Is Working” when it comes to the behemoth banks on Wall Street.

JPMorgan’s sprawling derivatives portfolio that encompasses $51 trillion notional amount as of December 31, 2015 is also causing angst at the Fed and FDIC. The regulators wanted more granular detail on what would happen if JPMorgan’s counterparties refused to continue doing business with it if rating agencies cut its credit ratings. The regulators asked for a “narrative describing at least one pathway” for winding down the derivatives portfolio, taking into account a number of factors, including “the costs and challenges of obtaining timely consents from counterparties and potential acquirers (step-in banks).” The regulators wanted to see the “losses and liquidity required to support the active wind-down” of the derivatives portfolio “incorporated into estimates of the firm’s resolution capital and liquidity execution needs.”

According to the Office of the Comptroller of the Currency’s (OCC) derivatives report as of December 31, 2015, JPMorgan Chase is only centrally clearing 37 percent of its derivatives while a whopping 63 percent of its derivatives remain in over-the-counter contracts between itself and unnamed counterparties. The Dodd-Frank reform legislation had promised the public that derivatives would all become exchange traded or centrally cleared. Indeed, on March 7 President Obama falsely stated at a press conference that when it comes to derivatives “you have clearinghouses that account for the vast majority of trades taking place.”

Paul Krugman and Hillary Clinton say everything’s under control. We’ll see about that.

For related articles, see:

Paul Krugman Once Again Irrationally Attacks Bitcoin…Here’s My Response

Paul Krugman Goes on the Attack: Calls Bitcoin “Antisocial”

Elizabeth Warren Releases Blistering Report on Corporate Criminality – Singles Out SEC Uselessness

Shots Fired – Jamie Dimon Questions Elizabeth Warren’s “Understanding of the Global Banking System”

Four “Too Big to Fail/Jail” Banks Threaten to Hold Back Funds to Democrats Over Elizabeth Warren

Video of the Day – Elizabeth Warren Torches Janet Yellen on TBTF

Elizabeth Warren Confronts Eric Holder, Ben Bernanke and Mary Jo White on Bankster Immunity

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.