Everything You Didn’t Know About Health Insurance Exchanges

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

The Affordable Care Act was voted into law as a way to ensure no individual is denied health insurance protection and that policy costs are reasonable and affordable. However, the cost of insurance policies differs depending on your own unique circumstances.

The rollout of what some are calling Obamacare has left many puzzled about how the Affordable Care Act will impact their savings.

According to a survey conducted by the Kaiser Family Foundation, 42 percent of Americans don’t know that the Affordable Care Act is law — 12 percent think it was repealed by Congress, 7 percent think it was overturned by the Supreme Court and 23 percent simply don’t know anything about the act’s status.

Further, a poll conducted by SurveyMonkey found that Americans are generally confused about what the health care law — and its so-called “health insurance marketplaces” — actually entail.

According to the survey’s findings, more than 40 percent of Americans are slightly or not at all familiar with the Affordable Health Care Act.

If you’re among these groups of individuals who are in the dark about how the Affordable Care Act will impact your finances, familiarizing yourself with how the exchanges work is the first step forward.

Related article: Obamacare Costs Vs. Average Savings Account Rates Today

The Difference Between Exchanges and Private Insurance Sites

Related Articles

Here’s the real difference between obtaining coverage through your state’s marketplace versus directly through an insurance company’s website.

Direct Insurance Websites

If you’re currently uninsured or are shopping around for other coverage options, health insurance providers are still offering direct sign-up through their websites.

The advantage of going straight through a provider is that its full breadth of plans is offered on-site. Some of these plans might be lower (or higher) in cost than the plan option the provider has chosen to include in your state’s marketplace.

Plans that are also available in marketplaces are often tagged for convenience. For example, on Kaiser Permanente’s website, an orange “M” annotates plans that can be found in your state’s exchange.

Health Marketplaces

Health marketplaces are a one-stop shop for you to browse a few selected private insurance plan options within each tier — bronze, silver, gold and platinum. However, plans found in the exchange tool offer the same benefits, deductibles and premium levels as their counterparts on the provider’s website.

The main advantage in comparing the prices of different plans from different providers is finding out if you’re eligible for federal tax credit subsidies on premiums in one fell swoop — this is where the savings come in. To receive the discount on premium costs, you’ll have to sign up for coverage through the exchange.

Read more: Obamacare: Health Care Exchanges Could Be Costly for Gen-Y

Cost Estimate Comparison

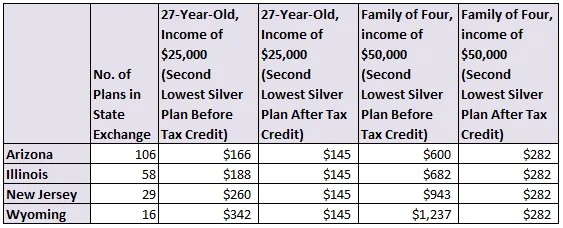

The cost of coverage across various states differs, depending on the level of insurance competitors in the area. A few examples of weighted plan averages across the entire state for a non-smoking 27-year-old and a family of four, according to the U.S. Department of Health and Human Services, are as follows:

What You Need to Know About the Affordable Care Act

1. 10 Essential Health Benefits You’ll Receive

Aside from the potential cost change associated with the implementation of new regulations, many are still unclear about the new benefits that are required in coverage plans moving forward.

The health care law states that all health insurance plans must cover at least the following 10 essential health benefits:

- Maternity Care: Women can receive medical attention throughout their entire pregnancy, including prenatal, delivery and post-delivery assistance. Newborns also receive in-hospital care.

- Free Preventative Care Services: Women’s wellness screenings, like Pap smears, physical examinations and immunizations are now all provided at no extra cost.

- Emergency Care: When in a life-threatening condition, patients will be able to visit an emergency room (regardless of whether the facility is in-network) for immediate care. The ambulance ride to the ER, which can cost thousands for those who are uninsured, is also included as an essential benefit.

- Outpatient Care: This benefit provides coverage to patients who need to see medical professionals, but don’t necessarily need to be admitted to a hospital. For example, doctor visits and same-day surgeries are classified under this category.

- Inpatient Care: The act requires that all health insurance plans include inpatient care, which is provided to patients who need to be admitted to a hospital. This includes care from doctors, nurses and administration staff, as well as in-hospital procedures, such as surgeries, transplants and other tests.

- Lab Services: X-ray services and preventative screenings (such as mammograms and prostate lab tests) must be a component of insurance plans moving forward.

- Mental Health and Addiction Treatment: Mental health and addition treatment is often an overlooked condition. However, the Affordable Care Act now provides care that helps diagnose and treat patients with mental health or substance abuse issues.

- Rehabilitation: Health insurance plans must provide at least 30 days of physical or occupational therapy per year to individuals who are recovering from a mental or physical injury.

- Pediatric Care: Children younger than 18 must receive wellness coverage for immunizations, vaccines and routine doctor’s visits. To ensure that their health is prioritized during their early developmental stages, vision and dental care are required.

- Prescription Drug Services: Medicine for short-term illnesses, such as bacterial infections and long-term conditions like diabetes, is covered.

2. There Are Three Ways to Obtain Health Coverage

There are multiple ways to obtain health coverage before January 2014. Those whose employers offer health insurance benefits can go through an employer-sponsored plan, while individuals who are eligible for Medicare or Medicaid can obtain insurance coverage through the government program.

All others must find their own plan. State health insurance exchanges, which can be found online, are a helpful way to compare plans from private insurance companies. However, uninsured individuals can also enroll for health insurance directly on insurance providers’ websites.

3. Individuals Face Penalties for Being Uninsured

Starting January 2014, everyone in the United States will be required to have some form of health coverage. Those who procrastinate or choose not to enroll in a plan by the start of the new year might face penalties under the Affordable Care Act.

Penalties for uninsured adults and children vary, and fines increase each year.

Related: Obamacare Could Help Medical Tourism Thrive

4. Two Ways to Receive Subsidies

Health insurance marketplaces identify whether an individual meets eligibility requirements for government subsidies. In order to claim the premium assistance, individuals have the option of having the credit deducted each month from their total premium costs, or have the entire amount credited during tax season.

5. The 9.5 Percent Rule

Congress has defined an “affordable” plan as being 9.5 percent or less of an individual’s household income. Those whose employer plans cost more than this threshold can go through the exchanges for coverage.

Written by

Written by