Smart Wires, a startup with technology that could turn transmission lines into flexible power conduits for an increasingly solar- and wind-powered grid, has raised $30.8 million to bring its first product to commercial production and ready its second for field testing early next year.

The new round, first reported in a May filing with the U.S. Securities and Exchange Commission, brings Smart Wires’ total funding to about $62.8 million, including a $10 million series A round, an $18 million series B round, and a nearly $4 million grant from ARPA-E, the Department of Energy energy research program. Previous investor 3x5 Special Opportunity Fund, an investment vehicle formed by RiverVest Venture Partners, Arnerich Massena & Associates, was the investor.

About $11.3 million of the new round has already come to the Oakland, Calif.-based company in the form of bridge loans, which with interest are being converted to roughly $11.6 million in convertible notes, Chief Financial Officer Mark Freyman said in a Wednesday interview. The remaining $19.2 million in equity is being brought into the company in tranches over the next 12 to 18 months, he said.

CEO Jim Davis noted that the startup has also brought on some big-name former utility executives, including Thomas Voss, former CEO, president and chairman of utility Ameren, who has joined as company chairman, and David Ratcliffe, former Southern Company CEO, who has joined the startup’s advisory board.

Smart Wires intends to use the money to bring its PowerLine Guardian device to commercial-scale production this year, and to complete development of its PowerLine Router device in hopes of putting it into trials in early 2016, he said.

Below is our most recent article on Smart Wires, which goes into more detail on how both devices work to throttle and augment power flow along transmission lines, respectively.

* * *

Transmission grids could be one of the bigger bottlenecks to growing the world’s share of green power. Built to push power from central power plants at steady outputs, along undisturbed paths, they aren’t well suited for cutting back or increasing throughput to match the intermittency of big wind and solar farms.

Oakland, Calif.-based startup Smart Wires says its technology could help open up these bottlenecks. That, in turn, could help reduce renewable energy curtailments, alleviate the cost and complexity of multi-state transmission upgrades, and allow the expansion of renewable power plants that couldn’t otherwise be built in far away, wind and sun-rich locales.

At least, that’s the long-term vision. So far, the Georgia Tech spinout, formerly named Smart Wire Grid, has tested its technology with the federal Tennessee Valley Authority and Southern Company subsidiary Georgia Power, with results that indicate it can do what it promises. Last month, it launched testing with Irish transmission system operator EirGrid -- and earlier this month, California utility Pacific Gas & Electric announced a pilot project that appears to be using Smart Wires’ technology.

Jim Davis, Smart Wires’ new CEO, said in an interview last week that the startup is also “collaborating with 25 of the largest global transmission organizations, to see how we can help them achieve their top strategic priorities.” While he declined to discuss details of those discussions, or to comment on the PG&E project, he did say that the company’s existing PowerLine Guardian devices and its Commander software management system -- and a next-generation product, called the PowerLine Router, set for pilot testing early next year -- could be “one of the most critical components of the future dynamic grid.”

“Being able to control the flow of power across your grid is one of the best tools to become available in a utility’s toolkit for a long time,” said Davis, a 25-year energy industry veteran who previously served as president of Chevron Energy Solutions. “For the first time, utilities, transmission owners and operators, are able to control the flow of power across this meshed network.”

Technology to squeeze, redirect, monitor the flow of high-voltage power

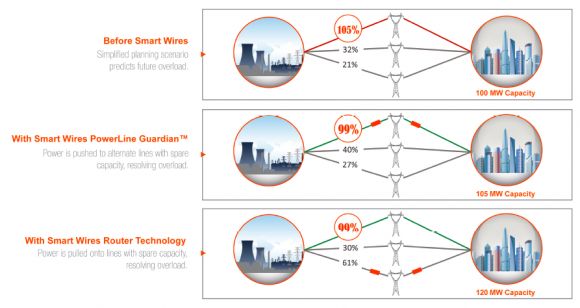

Smart Wires’ key innovation is its PowerLine Guardian -- a device similar to a current transformer with on-board computing and cellular connectivity, that mounts directly on transmission lines and adds impedance as needed to “choke” the flow of electrons through overloaded lines and redirect it to other transmission corridors.

Its first test was with TVA, which installed 100 of these devices across about 20 miles of 161-kilovolt transmission lines. The startup debuted the results of its TVA pilot at the 2013 ARPA-E Energy Summit outside Washington, D.C., as part of a showcase of the Department of Energy research program’s early success stories.

_509_178_80.jpg)

The next test with Georgia Power started in 2013, with 33 units installed on two 115-kilovolt transmission lines and run continuously for 16 months. According to a January 2015 report, all but two of the devices were still operational at the end of the test, and successfully demonstrated their ability to control power flow as modeled before installation -- results that led Georgia Power to double their fleet of the devices last year.

The goal was to prove the technology could be integrated into existing or new transmission networks, and help bring a new solution to managing the transmission of power across a potentially overloaded system, according to Michael Grabstein, Smart Wires solutions engineer. Today, grid operators facing an overabundance of transmission-constrained generation have essentially two choices: build new lines to carry it to the loads that need it, or curtail the generation -- that is, shut it down.

These problems are already happening today in places like West Texas or the Pacific Northwest, where grid operators have been forced at times to curtail wind power because they’re generating more electricity than the system can safely transmit at the time. “That’s currently the only way utilities can maintain reliability -- and that’s giving up the economics of utilizing the cheapest energy,” Grabstein said.

With the Smart Wires devices in place, by contrast, “we would push power from the overloaded line to the under-utilized lines, and increase the total system capacity,” he said. The devices are built to function autonomously to reduce loading on circuits when they reach certain triggers, or through the startup’s Commander software to act in coordination with utility control centers, he said.

Smart Wires’ guardian devices can “choke” power on a line. But its next product, the PowerLine Router, is aimed at directly increasing the throughput of underutilized lines, Grabstein said.

“The router has the same guts to it” as the PowerLine Guardian, “but it also has some other technology that’s harvesting power, converting that, and rather than just injecting the magnetizing impedance, it’s injecting a leading or lagging voltage through that transformer, and synthesizing inductance or capacitance,” he said.

Today, some of that functionality is performed by series capacitors, but “a synthesized capacitance has huge benefits over a traditional series capacitor,” he said. Those include the ability to filter harmonic distortion, improve stability and mitigate, rather than induce, sub-synchronous resonance.

In some ways, the router is seeking to effect similar digital power controls on the transmission grid that devices from companies like Gridco and Varentec are performing on distribution grids. In fact, Varentec President and CTO Deepak Divan also first conceptualized Smart Wires’ Router technology while working at Georgia Tech, Grabstein said.

But the router device has come second in terms of development because “it’s a more complex operation, and requires a greater level of integration and a greater awareness of the system at large,” he said.

Today’s transmission grids do have existing technologies, like phase-shifting transformers or flexible alternating current transmission systems (FACTS), which can perform some similar functions, Grabstein said. But they’re big and complex machines sited at substations serving the highest-voltage power lines, whereas Smart Wires work well on networks at and below 230 kilovolts, and avoid any single point of failure, he said.

Transmission grids at a crossroads -- and technology to help

That’s going to become increasingly important as transmission operators struggle to upgrade an aging grid to manage increasing amounts of renewable energy, Davis said. In that sense, Smart Wires’ technology is “coming along at the perfect time.”

Advances in wide-area communications, materials sciences and power electronics over the past decade or so begun to allow this kind of technology to emerge as a viable alternative to business as usual on the transmission grid, he said. But the other piece to the puzzle has been the changing landscape for transmission grid operators, he said.

“The proliferation of renewables, the environmental pressure to retire base-load power plants, sort of created the opportunity,” he said. “Whereas in the past, you sort of solved the problems with brute force,” today’s grid economics are making that a much more challenging proposition.

Simply put, U.S. electricity demand is flattening, which means that the rate increases through which grid upgrades are traditionally financed are becoming harder to justify. Most of today's generation growth is coming from wind and solar power, which brings increased variability in power output. But it’s hard to get ratepayers to spend money building brand new power lines that may only be required to deliver power only for relatively rare peaks in generation.

The U.S. Energy Information Administration has tracked an uptick in transmission grid spending over the past decade, largely to boost resiliency after the 2003 blackout in the U.S. Northeast, as well as to help carry power from Midwest wind farms to population centers. But that investment is set to fall over the remainder of the decade, according to The Edison Electric Institute.

Meanwhile, the American Society of Civil Engineers gave the nation’s energy infrastructure a “D+” grade in a 2013 report, and said that current plans could lead to a $37 billion investment gap in transmission by 2020. The Edison Electric Institute has highlighted $60.6 billion in transmission investments that will be necessary to modernize the transmission system through 2024, and three-quarters of that is in support of new renewable resources.

The kind of flexibility that Smart Wires is promising could help reduce the “brute force” transmission capacity requirements used in today’s transmission planning, Davis noted. Ireland’s EirGrid, which is dealing with a lot of wind power, is examining how it could use the startup’s technology for “primarily eliminating or avoiding building new lines,” for example, he noted.

Even where new high-voltage transmission lines do need to be built, Smart Wires could help make the integration of that power much simpler at the point where it’s being delivered, Grabstein said. That includes new high-voltage direct current transmission projects carrying massive amounts of wind power across long distances -- “We’re not going to avoid that – but we’re going to make that interconnection more efficient.”

Meanwhile, the Federal Energy Regulatory Commission’s Order 1000 requires cost-sharing for grid investments that affect multiple states and utility jurisdictions, and adds the burden of taking state carbon reduction and renewable energy integration policies into account. In that regulatory environment, “a company building a large line like that is going to harvest the economic value of that project -- but they’re going to be responsible for paying for all the ancillary upgrades,” he said. “They have to make sure they don’t cause problems on other parties’ systems.”

Last week, the Obama administration released its first-ever Quadrennial Energy Review, which identified billions of dollars in technology investments required to bring more resiliency, security and green energy integration capability to the country’s power grid. One of the report’s recommendations is to spend $3.5 billion in R&D spending over the next 10 years for “new tools and technologies” such as “system control and power flow to optimize for new grid capabilities” and “grid sensing and measurements for determining changes in variable generation markets and infrastructure conditions.” It’s possible that Smart Wires’ technology could fit into these categories.

Davis said that the company is hoping the next step into commercialization will be a “system-wide deployment,” involving the startup’s technical assistance in doing a system-wide analysis, and then applying its technology to those projects where it can help reduce costs and improve efficiency and safety. Making changes in the world of transmission grids takes a lot of time, of course -- but on that schedule, Smart Wires could be considered as closing in on the finish line.