Thermoelectric materials can convert waste heat into usable power. The technology is a brilliant materials research pursuit, but it has not yet been brought to mass markets economically or at scale -- despite decades of R&D and billions invested. But now that might be changing.

Thermoelectric stakeholders speak of "trillion-dollar" quad-sized markets in sub-1-megawatt waste heat recovery with huge target verticals such as automotive, oil, gas, mining, glassmaking, and sensors -- but the technology is still working out the kinks and costs.

Alphabet adds new thermoelectric materials system

Matt Scullin, the CEO of thermoelectrics startup Alphabet Energy, regards the automotive sector as the "holy grail" market for thermoelectrics, but in the meantime, his company is building and commercializing a 25-kilowatt system which generates electricity from exhaust-gas waste heat in oil and gas applications.

Scullin said that 25-kilowatt system is "a stepping stone and proving ground for the wider market. At the end of the day, we are not a company to build 25-kilowatt thermal generators. The way we get bigger is by selling the core technology."

Although Alphabet Energy has been working with silicon nanowire for years and believes it to be "the material with most potential -- right now, that's an ongoing project." Traditional thermoelectrics use materials such as bismuth telluride or silicon germanium.

The materials currently in production at Alphabet are a combination of magnesium silicide and tetrahedrite. "We latched onto tetrahedrite because it is a light element, abundant, and cheap," said the CEO. The material is composed of common copper-antimony-sulfur mineral compounds, according to Chemical and Engineering News, and based on technology licensed from Michigan State University.

Scullin said that Alphabet is making large ingots of thermoelectric materials -- orders of magnitude larger than other companies have been able to achieve.

Scullin suggests that the startup scene doesn't accurately reflect the investments or progress being made in thermoelectrics by large industrial firms across the globe. GM, for example, is researching the behavior of skutterudites, materials with ZT values that are "greatest at the high temperatures typical of automobile exhaust systems."

Alphabet Energy has raised more than $30 million from Encana, a developer of natural gas and other energy sources, TPG Biotech, Claremont Creek Ventures, and the CalCEF Clean Energy Angel Fund.

Evident acquires defunct KP-funded GMZ

Evident Thermoelectrics just bought the assets of GMZ Energy, a shuttered thermoelectric technology startup that was spun out of MIT with funding from KPCB, BP Alternative Energy, and Mitsui Ventures. GMZ was working on bismuth-telluride thermovoltaic devices to convert solar heat directly into power via the Seebeck effect. (In the Seebeck effect, a sharp temperature gradient can result in an electric charge.)

According to a release, GMZ's most recent "technology focus was on half-Heusler materials, which are high-temperature, stable semiconductor nanomaterials and well suited for thermoelectric applications like waste heat recovery." According to a recent article in Semiconductor Science and Technology, these materials have "the combination of different properties such as superconductivity and topological edge states [leading] to new multifunctional materials, which have the potential to revolutionize technological applications."

Clint Ballinger, the CEO of GMZ acquirer Evident in Troy, New York, told GTM that his firm is going after high-temperature thermoelectric applications, different than what GMZ is pursuing, an area that is much more rife with "ready markets." The market-entry product will have a generation capacity in the range of "a few hundred watts to a kilowatt."

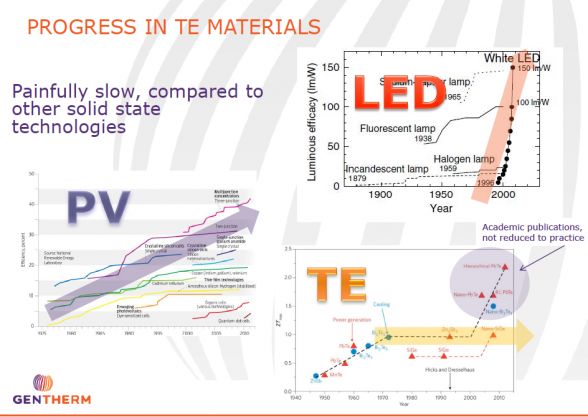

Figure: Slow Materials Progress in Thermoelectrics

Source: ARPA-E Small Engines Workshop, May 2014, Dmitri Kossakovski, Advanced R&D, Gentherm, Thermoelectric Power Generation

More approaches to thermoelectrics

Global Thermoelectric, recently acquired by Gentherm, uses lead-tin-telluride thermoelectric technology developed by 3M for NASA's Apollo program. The company has deployed 20,000 units in the field for generating power at remote sites.

MicroPower combines thermoelectrics and thermionics for higher efficiencies.

The near-term applications for Phononic's thermoelectrics include high-end refrigeration for labs and medical facilities, as well as cooling for fiber optics and data servers. Phononic is looking to develop thermal management technology for consumer devices, and, more strikingly, to replace cheap, ubiquitous and century-old incumbent compressor technology. Phononic's CEO Anthony Atti told us in an earlier interview that "semiconductors have revolutionized IT and LEDs, but have not had that same impact on cooling and heating." He notes that Phononic's thermoelectric technology is in the realm of Peltier cooling technology, but addresses three major shortcomings of that technology: efficiency, ability to scale, and ease of integration.

Phononic has raised more than $85 million in venture funding from investors including Eastwood Capital, Wellcome Trust, WLR China Energy Infrastructure Fund, Tsing Capital, Venrock, Oak Investment Partners, and Rex Health Ventures.

Silicium Energy, funded by Khosla Ventures, is investigating high ZT thermoelectrics. The firm's website claims, "Silicium is developing silicon thermoelectrics that enable substantially increased battery longevity for wearable electronics. By using body heat, Silicium technology can help power an entire spectrum of wearable devices...using off-the-shelf silicon wafers." A paper by the founders notes, "Silicon in particular has very different length scales for heat and electron transport. Recently, silicon-based thermoelectric devices that utilize a finely tuned nanostructure have delivered high performance in the lab."

NanoConversion Technologies' thermally regenerative concentration cell is a non-semiconductor thermoelectric based on the alkali-metal thermal-to-electric converter (AMTEC), invented by Ford in the 1960s. The device takes 850°C heat as an input and produces direct current electrical power and thermal heating power at 200°C, at potentially high efficiencies of up to 30 percent, according to the company, and when using the heat, over 90 percent. One application for NanoConversion's device, called the C-TEC, would be as part of the homeowner's boiler or water heater, where it would produce some of the home's electricity, as well as heating the home's water.

Not a thermoelectric

MTPV has technology capable of harvesting waste, but CEO David Mather was careful to describe the company's technology as a thermophotovoltaic, not a thermoelectric.

Mather contrasted the typically low efficiencies of semiconductor thermoelectric materials (in the very low single-digit-percentage range) with those of thermophotovoltaic materials, which have efficiencies in the 30 percent to 60 percent range, using a "micron gap" technology to better isolate the hot side from the cold side and provide a larger temperature difference.

Mather claims to be beta-testing the devices with "several commercial partners." The first application will be in industrial waste heat harvesting in capacities greater than 10 kilowatts. The CEO asserts that costs will be more in line with solar because the startup is using commodified materials, not exotics, as in thermoelectrics. The CEO said that the emitting device is basically made of silicon and the receiver is a III-V semiconductor compound built with standard processing.

The company has raised $11.2 million from investors including Northwater Capital Management’s Intellectual Property Fund, Total Energy Ventures, SABIC, the Saudi Basic Industries Corporation, Spinnaker Capital, Ensys Capital, and the Clean Energy Venture Group.

The United States is the Saudi Arabia of waste heat, but lacks the technology to mine this resource. Startups and industrial giants are searching for the right material combination that will be cheap, earth-abundant, scalable and efficient. It's a tough challenge in terms of physics, engineering and manufacturing.

And we're not there yet.