TV Still The King Of The Screens: comScore

The television set continues to be the most-used screen for watching original TV series, but time spent watching TV on mobile and connected devices continues to grab share, particularly among consumers in the tech-savvy Millennials (18-34 year-olds) group, comScore found in a new video viewership study.

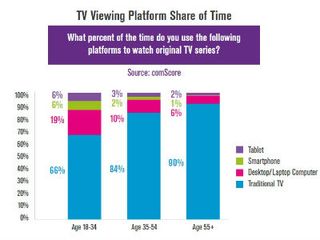

The study – The U.S. Total Video Report, which tabulated results from 1,159 respondents in August – found that Millennials spend about one-third of their original TV series consumption time watching on digital platforms. Boiled down by category, 66% of that time watching TV among Millennials was done on a traditional television, versus 19% of that time on desktops and laptops, 6% on smartphones, and 6% on tablets.

According to the study, about 84% for consumers in the 35-54 year-old age group spent their time watching scripted TV shows on the traditional television, rising to 90% among consumers who are 55 years or older.

More than half of those surveyed said schedule flexibility (56%) and convenience (52%) were the main reasons for watching TV content on the internet, edging out the ability to skip commercials (38%), the ability to binge watch (35%) and the lower cost for consumers (29%).

Younger adults are also more apt to time-shift. comScore also found that 46% of Millennials’ viewing is typically watched in a time-shifted manner, versus 35% percent among 35-54 year-olds, and 30% among those who are older than 55.

Among other findings, consumers who subscribe to paid digital video services are more likely to binge-view TV shows over a monthly period – 87% vs. 69%. TV via the DVR (43%) is the preferred binge-viewing platform, followed by the TV via VOD (19%); Internet connected TV devcies (12%); live TV – a category that includes reruns or marathons from MVPDs – (11%); tablets (4%), desktops/laptops (3%); and smartphones (2%).

Unsurprisingly, Millennials are also more likely to be cord-nevers or cord-cutters.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Adults 18-34 are 77% more likely than average to be a cord-never household, and 67% are more likely to be a cord-cutter, comScore noted.

Among homes surveyed that don’t take pay-TV services, the survey found that 60% are single-person households, and 52% are in homes without children.

comScore, which uses an approach called Total Video to track unduplicated audience metrics across platforms, conducts the study under the belief that the TV viewership behaviors of Millennials and other “tech-forward segments” will inevitably become more mainstream.