Where can you get the most Big Mac for your buck?

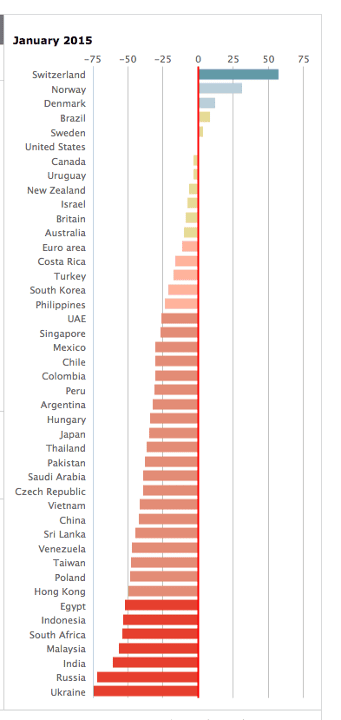

The answer is Ukraine, according to the Economist’s latest Big Mac Index, a tool the magazine invented in 1986 to explain currencies’ relative values.

The most expensive Big Mac, meanwhile, is in Switzerland and that was even before the Swiss franc shot up last week after the country’s central bank abandoned its currency peg against the euro.

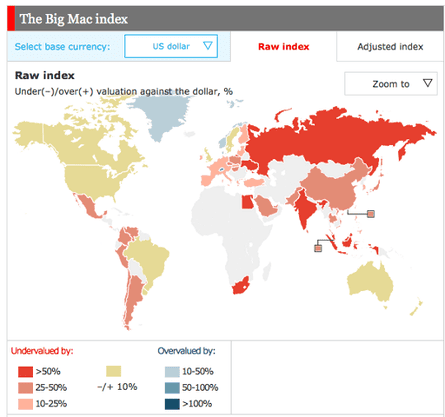

The index is based on the theory of purchasing-power parity (PPP), that over the long run, currencies should adjust so that a basket of identical goods costs the same everywhere. To keep things simple, in its bid to show whether currencies are at their “correct” level, the Economist uses just one item: the Big Mac burger.

For example, the average price of a Big Mac in the US this January was $4.79; in China it was only $2.77 at market exchange rates. So the Big Mac index says that the yuan was undervalued by 42% at that time. Buying a Big Mac in Switzerland costs $6.38 at market exchange rates, suggesting the Swiss franc was about 33% overvalued. Since last week’s ditching of the euro peg the price has risen to $7.54.

The index suggests the euro is around 11% undervalued against the dollar.

Other insights from the latest index are that the currencies of commodity exporters are those that have lost the most ground relative to the dollar – so the Brazilian real, Russian rouble and Norwegian kroner have all weakened. But energy importers China and India have seen their currencies strengthen against the dollar.

For those who can stomach (yes, I know what I did there) what is quite possibly the biggest number of food puns ever squeezed into one article, the Economist has full details of this year’s index. There is also an interactive map that adjusts the “raw” index to address the criticism that you would expect average burger prices to be cheaper in poor countries than in rich ones because of relative labour costs.

Comments (…)

Sign in or create your Guardian account to join the discussion