A federal bankruptcy judge has approved the auction of nearly all of HashFast’s remaining assets, putting the company out of business for good. According to court records, HashFast owes over $40 million to creditors primarily in the United States, but also to some customers in Europe, Russia, India, New Zealand, Australia, and Canada.

Last Wednesday, US Bankruptcy Judge Dennis Montali granted the company’s request to sell thousands of its chips, wafers, mining boards, cooling fans, and older models of its miners. In addition, bidders will also be able to buy "claims and causes of action against Simon Barber, co-founder and Chief Technology Officer of the Debtors, including preference, fraudulent transfer, and breach of fiduciary duty claims." The court documents did not say what, if anything, would become of the company's holdings in bitcoins.

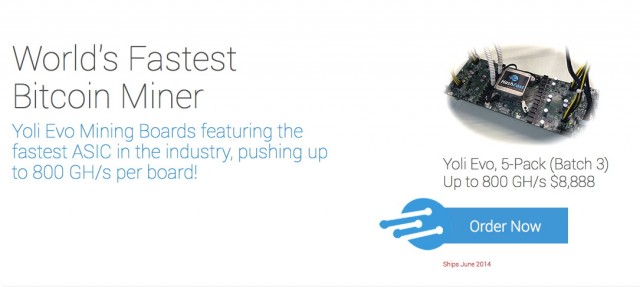

Over the last several months, the San Francisco startup, which makes Bitcoin mining hardware, has been faced with an increasing number of lawsuit and arbitration claims.

HashFast’s execution problems appear to be endemic to many of its rivals, including Butterfly Labs (which is also facing its own civil suit brought by the Federal Trade Commission) and venture-backed CoinTerra. These companies are frequently unable to deliver mining hardware on-time and either significantly delay or outright deny to issue refunds. Of course, in the world of Bitcoin, mining becomes harder over time, so miners quickly diminish in value.

In May 2014, HashFast famously declared "we are not scammers." Days later, CEO Eduardo deCastro told Ars during an interview: "We are as poor as church mice." Then HashFast was hit with an "involuntary bankruptcy petition," a process that eventually resulted in the company filing for Chapter 11 bankruptcy protection and now concludes with the firm selling off everything that it owns.

"Last I heard, they have about five bitcoins," Ray Gallo, one of the lawyers representing creditors trying to get money back from HashFast, told Ars. "I think the company is out of money so I think the final employees resigned. Yes, somebody could buy claims against Barber. I’m not sure those have any value though."

He added that he would be surprised if he clients were able to collect anything from HashFast.

DeCastro is no longer mentioned anywhere on the HashFast website, but his LinkedIn profile says he still is the company’s CEO. Neither he nor anyone from the company immediately responded to Ars’ request for comment. (Its Twitter account has not been active since May 2014.)

Other court filings show that as of September 14, 2014, HashFast had over $7 million in assets, but over $14 million in liabilities and only about $124,000 cash on hand.

Gallo explained that the difference between this $14 million amount and the claimed $40 million figure stems from HashFast's "failure to book the dollar value of the bitcoin refunds they owe."

"August 2013 purchasers were required to pay in bitcoin," he said. "The debts are booked at the August 2013 dollar value of the bitcoins customers actually paid. But the contract requires a bitcoin refund, and that refund right accrued on January 1, 2014, when bitcoins were worth about $770 each—a lot more than they were in August. HashFast took the exchange risk and didn’t hedge it. Then they couldn’t pay the refunds."

The auction is set to take place at 10am Pacific Time on December 4, 2014 at Four Embarcadero Center, 17th Floor, in downtown San Francisco.

reader comments

66